hawaii federal tax id number search

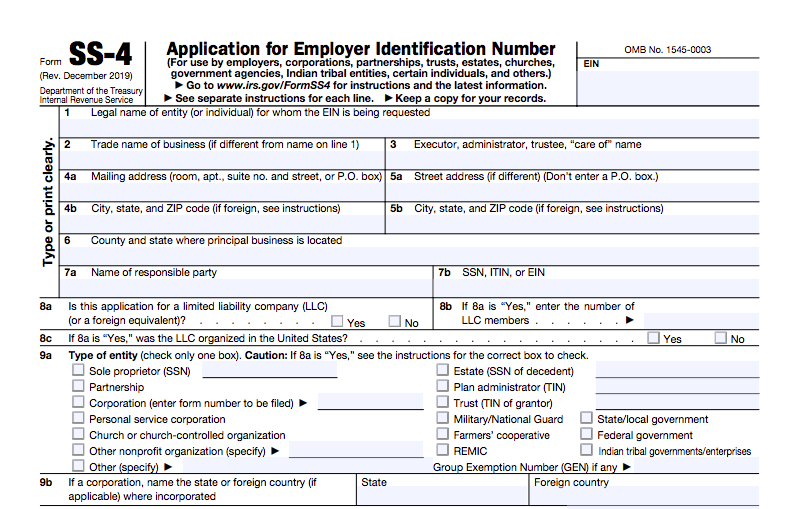

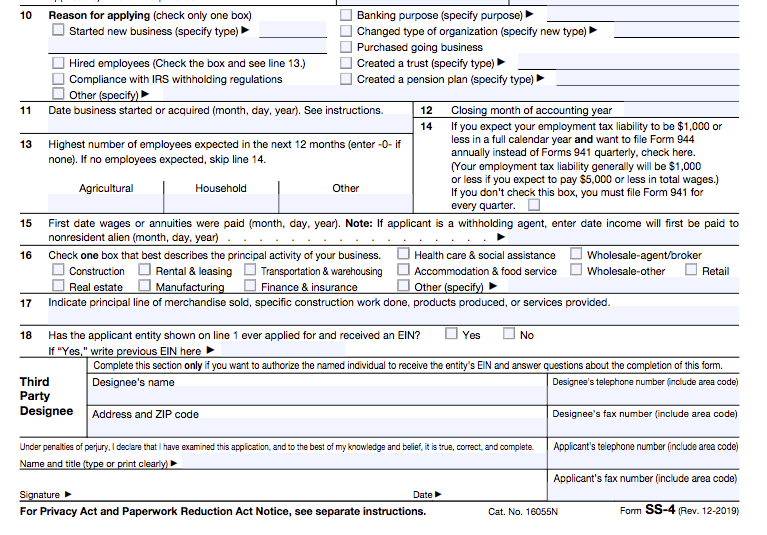

You can get a tax ID in. Employers engaged in a trade or business who pay compensation Form 9465.

Tax Id Numbers Why They Re Important And How To Get One Bench Accounting

This ID number should not be associated with other types of tax accounts with the state of Hawaii such as income tax.

. Hawaii Tax ID Number Changes. To learn more about the differences between the GET and sales tax. See a full list of all available functions on the site.

The GE account type stands for General ExciseUse and County Surcharge Tax. A Federal Tax Identification Number is used in many ways- for example- employers sole proprietors corporations partnerships non-profit organizations trusts and estates certain individuals and other types of business. Employees Withholding Certificate Form 941.

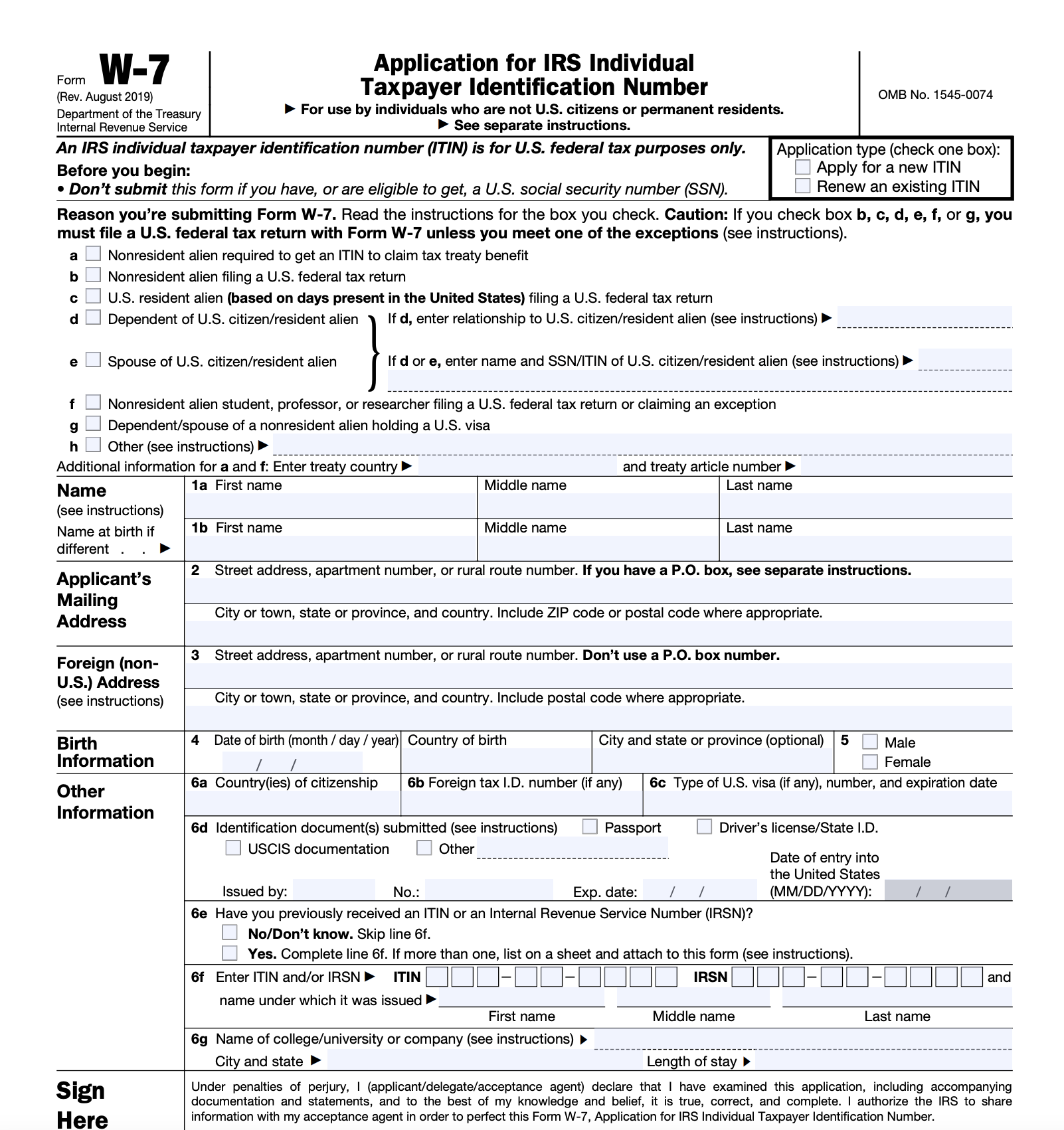

Hawaii Tax Online currently supports General Excise Transient Accommodations Withholding Use Only Sellers Collection Corporate income Franchise Rental Motor Vehicle County Surcharge and Public Service Company taxes. A Federal Tax Ientification Number EIN 4. A Hawaii tax id number can be one of two state tax ID numbers.

Be prepared when it comes to your taxes with the right federal tax ID number for the job. Use your federal tax ID number to provide your employers with it and also to file your own taxes. You can start your business and get a tax ID in AIEA cost to start is about 10817 or could start with 106677 that depends on your budget.

You can learn more about this update here on the states website Hawaii. The Department of Taxation is moving to a new integrated tax system as part of the Tax System Modernization program. Hawaii does not have a sales tax.

As of August 14 2017 this system supports the following business tax accounts. Aiea Monday April 22 2019 100646 AM. A wholesale License is a sales tax ID number.

Request for Transcript of Tax Return. Fed Tax Id Number 1- 24 hours - We send you the Number by Email to use to open your business bank account. Individuals can register online to receive their ID by filing Form BB-1 through Hawaii Business Express.

Note the govt will send you a welcome package within 1-2 weeks. Opening a business in Hawaii means taking the opportunity to invest in a unique economy with strong international ties and a vibrant base for tourism. Beginning November 13 it will also support Individual Income Partnership EstateTransfer and Fiduciary tax types.

Employers Quarterly Federal Tax Return Form W-2. The Hawaii tax ID is entered on Hawaii Form N-11 is the General ExciseUse and County Surcharge Tax GE and is in the format of GE-987-654-3210-01 Use the Hawaii Tax Online search engine to find the latest Hawaii Tax ID numbers. Instead we have the GET which is assessed on all business activities.

Obtain your Tax ID in Hawaii by selecting the appropriate entity or business type from the list below. Hawaiʻi Tax Online is the convenient and secure way to get a State Tax Identification Number BB-1 file tax returns make payments manage your accounts and conduct other common transactions online with the Hawaiʻi Department of Taxation. Not just the pages but even the text within all the Microsoft Word Excel and Adobe PDF files that we have posted over the years.

Its the unique identification number assigned to each Hawaii tax account. A sellers permit also called a sales tax ID or a state employer Number ID for employee tax withholding. Tax ID Hawaii Tax ID Hawaii.

In August 2017 Hawaiis Department of Taxation began a modernization project which also included a change in the format of the Hawaii Tax ID numbers. Sr vitch Wireless Telecommunications HI LLC. Once your application has been submitted our agents will begin on your behalf to file your application and obtain your Hawaii Tax ID.

After your Tax ID is obtained it will be sent to you via e-mail and will be available for immediate use. And IF you sell or buy wholesale retail a n Sales Tax ID Number Sellers Permit Wholesale License Resale State ID 2. The tax rate is 015 for Insurance Commission 05 for Wholesaling Manufacturing Producing Wholesale Services and Use Tax on Imports For Resale and 4 for all others.

Then there is a Federal Tax ID Number a Business Tax Registration Number and a Social Security Number for your personal income tax. Rental Motor Vehicle Tour Vehicle and Car-Sharing Vehicle Surcharge Tax RV Taxpayers will benefit from faster. The Hawaii Tax ID starts with a two-letter account type identifier followed by 12 digits.

This custom search allows you to search the entire Department of Taxations Website. State Tax Id Number Tax Identification Number varies but average time is 1-8 DAYS -. Request for Taxpayer Identification Number TIN and Certification Form 4506-T.

Hawaii State Website. From within your TaxAct return Online or Desktop click the State dropdown then click Hawaii on smaller.

Lyft Ein Number A Critical Component Of Your Taxes Ridester Com

Minnesota Department Of Revenue Minneapolis Mn Mm Financial Consulting Minneapolis Lettering Letter I

Taxpayer Identification Number Guyana Revenue Authority

Understanding The Employer Identification Number Ein Lookup

Tax Clearance Certificates Department Of Taxation

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

Hawaii Tax Id Ein Number Application Business Help Center

Smile Your Dental Expenses May Qualify As A Tax Deduction Delta Dental Of Arizona Blog Tips For Healthy Teeth Happy Smiles Dental Insurance Plans Dental Insurance Dental

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

Taxpayer Identification Number Guyana Revenue Authority

Is There A Way To Find My Unemployment Id Number I

Individual Taxpayer Identification Number Itin Guide For Immigrants

Understanding The Employer Identification Number Ein Lookup

Licensing Information Department Of Taxation

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

Irs Tax Debt Relief Elk Rapids Mi 49629 M M Financial Blog Tax Debt Relief Tax Debt Irs Taxes

Hawaii Rental Application Template Rental Application Hawaii Rentals Rental